Page 250 - Bank-Muamalat_Annual-Report-2023

P. 250

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

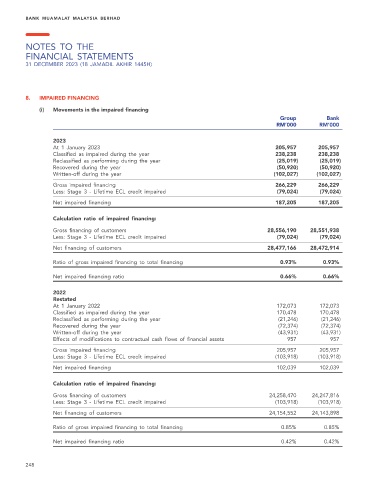

8. IMPAIRED FINANCING

(i) Movements in the impaired financing

Group Bank

RM’000 RM’000

2023

At 1 January 2023 205,957 205,957

Classified as impaired during the year 238,238 238,238

Reclassified as performing during the year (25,019) (25,019)

Recovered during the year (50,920) (50,920)

Written-off during the year (102,027) (102,027)

Gross impaired financing 266,229 266,229

Less: Stage 3 - Lifetime ECL credit impaired (79,024) (79,024)

Net impaired financing 187,205 187,205

Calculation ratio of impaired financing:

Gross financing of customers 28,556,190 28,551,938

Less: Stage 3 - Lifetime ECL credit impaired (79,024) (79,024)

Net financing of customers 28,477,166 28,472,914

Ratio of gross impaired financing to total financing 0.93% 0.93%

Net impaired financing ratio 0.66% 0.66%

2022

Restated

At 1 January 2022 172,073 172,073

Classified as impaired during the year 170,478 170,478

Reclassified as performing during the year (21,246) (21,246)

Recovered during the year (72,374) (72,374)

Written-off during the year (43,931) (43,931)

Effects of modifications to contractual cash flows of financial assets 957 957

Gross impaired financing 205,957 205,957

Less: Stage 3 - Lifetime ECL credit impaired (103,918) (103,918)

Net impaired financing 102,039 102,039

Calculation ratio of impaired financing:

Gross financing of customers 24,258,470 24,247,816

Less: Stage 3 - Lifetime ECL credit impaired (103,918) (103,918)

Net financing of customers 24,154,552 24,143,898

Ratio of gross impaired financing to total financing 0.85% 0.85%

Net impaired financing ratio 0.42% 0.42%

248