Page 249 - Bank-Muamalat_Annual-Report-2023

P. 249

ANNUAL REPORT 2023

OUR NUMBERS

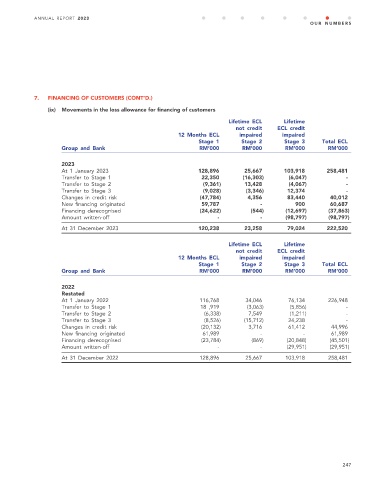

7. FINANCING OF CUSTOMERS (CONT’D.)

(ix) Movements in the loss allowance for financing of customers

Lifetime ECL Lifetime

not credit ECL credit

12 Months ECL impaired impaired

Stage 1 Stage 2 Stage 3 Total ECL

Group and Bank RM’000 RM’000 RM’000 RM’000

2023

At 1 January 2023 128,896 25,667 103,918 258,481

Transfer to Stage 1 22,350 (16,303) (6,047) -

Transfer to Stage 2 (9,361) 13,428 (4,067) -

Transfer to Stage 3 (9,028) (3,346) 12,374 -

Changes in credit risk (47,784) 4,356 83,440 40,012

New financing originated 59,787 - 900 60,687

Financing derecognised (24,622) (544) (12,697) (37,863)

Amount written-off - - (98,797) (98,797)

At 31 December 2023 120,238 23,258 79,024 222,520

Lifetime ECL Lifetime

not credit ECL credit

12 Months ECL impaired impaired

Stage 1 Stage 2 Stage 3 Total ECL

Group and Bank RM’000 RM’000 RM’000 RM’000

2022

Restated

At 1 January 2022 116,768 34,046 76,134 226,948

Transfer to Stage 1 18 ,919 (3,063) (5,856) -

Transfer to Stage 2 (6,338) 7,549 (1,211) -

Transfer to Stage 3 (8,526) (15,712) 24,238 -

Changes in credit risk (20,132) 3,716 61,412 44,996

New financing originated 61,989 - - 61,989

Financing derecognised (23,784) (869) (20,848) (45,501)

Amount written-off - - (29,951) (29,951)

At 31 December 2022 128,896 25,667 103,918 258,481

247