Page 163 - Bank-Muamalat_Annual-Report-2023

P. 163

ANNUAL REPORT 2023

GOVERNANCE

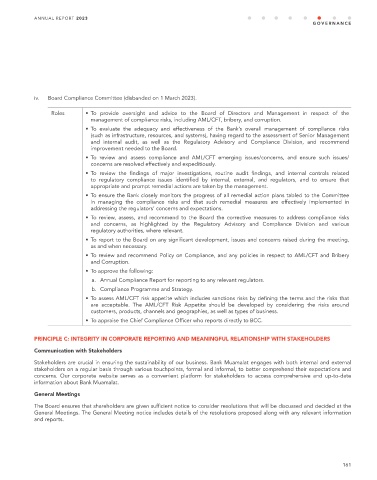

iv. Board Compliance Committee (disbanded on 1 March 2023).

Roles • To provide oversight and advice to the Board of Directors and Management in respect of the

management of compliance risks, including AML/CFT, bribery, and corruption.

• To evaluate the adequacy and effectiveness of the Bank’s overall management of compliance risks

(such as infrastructure, resources, and systems), having regard to the assessment of Senior Management

and internal audit, as well as the Regulatory Advisory and Compliance Division, and recommend

improvement needed to the Board.

• To review and assess compliance and AML/CFT emerging issues/concerns, and ensure such issues/

concerns are resolved effectively and expeditiously.

• To review the findings of major investigations, routine audit findings, and internal controls related

to regulatory compliance issues identified by internal, external, and regulators, and to ensure that

appropriate and prompt remedial actions are taken by the management.

• To ensure the Bank closely monitors the progress of all remedial action plans tabled to the Committee

in managing the compliance risks and that such remedial measures are effectively implemented in

addressing the regulators’ concerns and expectations.

• To review, assess, and recommend to the Board the corrective measures to address compliance risks

and concerns, as highlighted by the Regulatory Advisory and Compliance Division and various

regulatory authorities, where relevant.

• To report to the Board on any significant development, issues and concerns raised during the meeting,

as and when necessary.

• To review and recommend Policy on Compliance, and any policies in respect to AML/CFT and Bribery

and Corruption.

• To approve the following:

a. Annual Compliance Report for reporting to any relevant regulators.

b. Compliance Programme and Strategy.

• To assess AML/CFT risk appetite which includes sanctions risks by defining the terms and the risks that

are acceptable. The AML/CFT Risk Appetite should be developed by considering the risks around

customers, products, channels and geographies, as well as types of business.

• To appraise the Chief Compliance Officer who reports directly to BCC.

PRINCIPLE C: INTEGRITY IN CORPORATE REPORTING AND MEANINGFUL RELATIONSHIP WITH STAKEHOLDERS

Communication with Stakeholders

Stakeholders are crucial in ensuring the sustainability of our business. Bank Muamalat engages with both internal and external

stakeholders on a regular basis through various touchpoints, formal and informal, to better comprehend their expectations and

concerns. Our corporate website serves as a convenient platform for stakeholders to access comprehensive and up-to-date

information about Bank Muamalat.

General Meetings

The Board ensures that shareholders are given sufficient notice to consider resolutions that will be discussed and decided at the

General Meetings. The General Meeting notice includes details of the resolutions proposed along with any relevant information

and reports.

161