Page 355 - Bank-Muamalat-Annual-Report-2021

P. 355

ANNUAL REPORT 2021 353

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

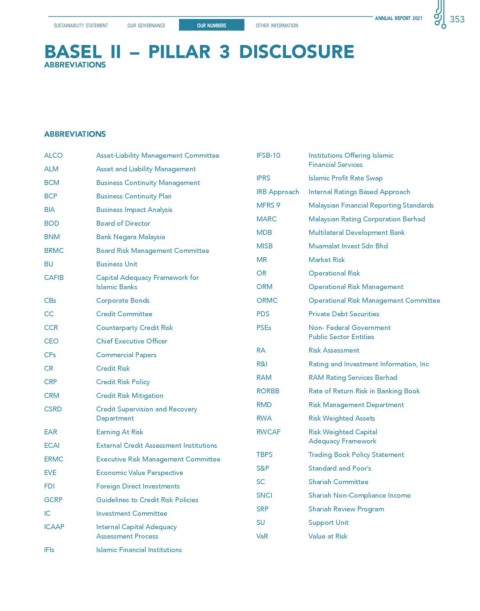

BAsel II – PIllAr 3 DIsclosure

ABBrevIATIons

ABBrevIATIons

ALCO Asset-Liability Management Committee IFSB-10 Institutions Offering Islamic

Financial Services

ALM Asset and Liability Management

IPRS Islamic Profit Rate Swap

BCM Business Continuity Management

IRB Approach Internal Ratings Based Approach

BCP Business Continuity Plan

MFRS 9 Malaysian Financial Reporting Standards

BIA Business Impact Analysis

MARC Malaysian Rating Corporation Berhad

BOD Board of Director

MDB Multilateral Development Bank

BNM Bank Negara Malaysia

MISB Muamalat Invest Sdn Bhd

BRMC Board Risk Management Committee

MR Market Risk

BU Business Unit

OR Operational Risk

CAFIB Capital Adequacy Framework for

Islamic Banks ORM Operational Risk Management

CBs Corporate Bonds ORMC Operational Risk Management Committee

CC Credit Committee PDS Private Debt Securities

CCR Counterparty Credit Risk PSEs Non- Federal Government

Public Sector Entities

CEO Chief Executive Officer

RA Risk Assessment

CPs Commercial Papers

R&I Rating and Investment Information, Inc

CR Credit Risk

RAM RAM Rating Services Berhad

CRP Credit Risk Policy

RORBB Rate of Return Risk in Banking Book

CRM Credit Risk Mitigation

RMD Risk Management Department

CSRD Credit Supervision and Recovery

Department RWA Risk Weighted Assets

EAR Earning At Risk RWCAF Risk Weighted Capital

Adequacy Framework

ECAI External Credit Assessment Institutions

TBPS Trading Book Policy Statement

ERMC Executive Risk Management Committee

S&P Standard and Poor’s

EVE Economic Value Perspective

SC Shariah Committee

FDI Foreign Direct Investments

SNCI Shariah Non-Compliance Income

GCRP Guidelines to Credit Risk Policies

SRP Shariah Review Program

IC Investment Committee

SU Support Unit

ICAAP Internal Capital Adequacy

Assessment Process VaR Value at Risk

IFIs Islamic Financial Institutions