Page 321 - Bank-Muamalat-Annual-Report-2021

P. 321

ANNUAL REPORT 2021 319

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

46. fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

(b) Market risk (cont’d.)

Types of market risk (cont’d.)

(ii) Non-traded market risk (cont’d.)

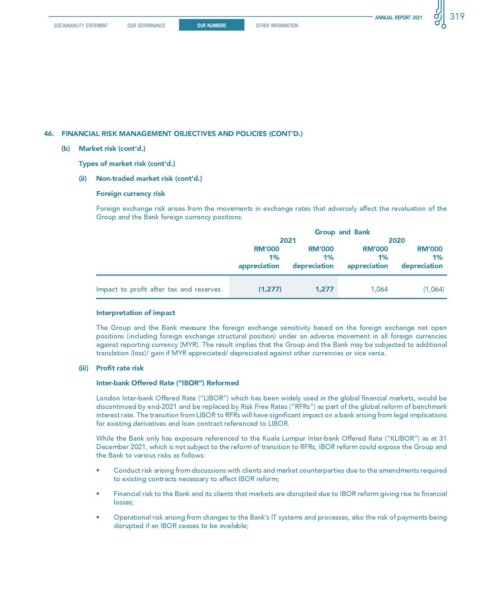

foreign currency risk

Foreign exchange risk arises from the movements in exchange rates that adversely affect the revaluation of the

Group and the Bank foreign currency positions.

Group and Bank

2021 2020

rM’000 rM’000 rM’000 rM’000

1% 1% 1% 1%

appreciation depreciation appreciation depreciation

Impact to profit after tax and reserves (1,277) 1,277 1,064 (1,064)

Interpretation of impact

The Group and the Bank measure the foreign exchange sensitivity based on the foreign exchange net open

positions (including foreign exchange structural position) under an adverse movement in all foreign currencies

against reporting currency (MYR). The result implies that the Group and the Bank may be subjected to additional

translation (loss)/ gain if MYR appreciated/ depreciated against other currencies or vice versa.

(iii) Profit rate risk

Inter-bank Offered Rate (“IBOR”) Reformed

London Inter-bank Offered Rate (“LIBOR”) which has been widely used in the global financial markets, would be

discontinued by end-2021 and be replaced by Risk Free Rates (“RFRs”) as part of the global reform of benchmark

interest rate. The transition from LIBOR to RFRs will have significant impact on a bank arising from legal implications

for existing derivatives and loan contract referenced to LIBOR.

While the Bank only has exposure referenced to the Kuala Lumpur Inter-bank Offered Rate (“KLIBOR”) as at 31

December 2021, which is not subject to the reform of transition to RFRs, IBOR reform could expose the Group and

the Bank to various risks as follows:

• Conduct risk arising from discussions with clients and market counterparties due to the amendments required

to existing contracts necessary to affect IBOR reform;

• Financial risk to the Bank and its clients that markets are disrupted due to IBOR reform giving rise to financial

losses;

• Operational risk arising from changes to the Bank’s IT systems and processes, also the risk of payments being

disrupted if an IBOR ceases to be available;