Page 348 - Bank-Muamalat_Annual-Report-2023

P. 348

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

47. FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (CONT’D.)

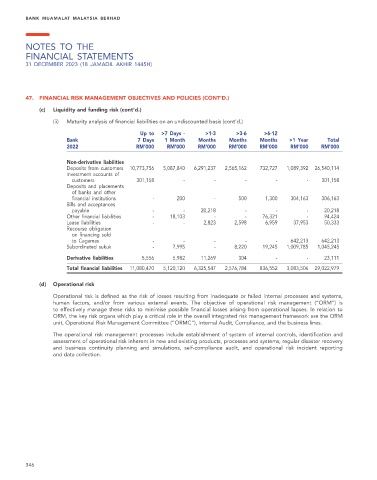

(c) Liquidity and funding risk (cont’d.)

(ii) Maturity analysis of financial liabilities on an undiscounted basis (cont’d.)

Up to >7 Days - >1-3 >3-6 >6-12

Bank 7 Days 1 Month Months Months Months >1 Year Total

2022 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

Non-derivative liabilities

Deposits from customers 10,773,756 5,087,840 6,291,237 2,565,162 732,727 1,089,392 26,540,114

Investment accounts of

customers 301,158 - - - - - 301,158

Deposits and placements

of banks and other

financial institutions - 200 - 500 1,300 304,163 306,163

Bills and acceptances

payable - - 20,218 - - - 20,218

Other financial liabilities - 18,103 - - 76,321 - 94,424

Lease liabilities - - 2,823 2,598 6,959 37,953 50,333

Recourse obligation

on financing sold

to Cagamas - - - - - 642,213 642,213

Subordinated sukuk - 7,995 - 8,220 19,245 1,009,785 1,045,245

Derivative liabilities 5,556 5,982 11,269 304 - - 23,111

Total financial liabilities 11,080,470 5,120,120 6,325,547 2,576,784 836,552 3,083,506 29,022,979

(d) Operational risk

Operational risk is defined as the risk of losses resulting from inadequate or failed internal processes and systems,

human factors, and/or from various external events. The objective of operational risk management (“ORM”) is

to effectively manage these risks to minimise possible financial losses arising from operational lapses. In relation to

ORM, the key risk organs which play a critical role in the overall integrated risk management framework are the ORM

unit, Operational Risk Management Committee (“ORMC”), Internal Audit, Compliance, and the business lines.

The operational risk management processes include establishment of system of internal controls, identification and

assessment of operational risk inherent in new and existing products, processes and systems, regular disaster recovery

and business continuity planning and simulations, self-compliance audit, and operational risk incident reporting

and data collection.

346