Page 184 - Bank-Muamalat_Annual-Report-2023

P. 184

BANK MUAMALAT MALAYSIA BERHAD

DIRECTORS’

REPORT

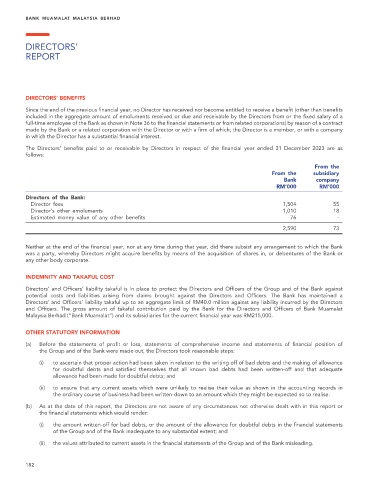

DIRECTORS’ BENEFITS

Since the end of the previous financial year, no Director has received nor become entitled to receive a benefit (other than benefits

included in the aggregate amount of emoluments received or due and receivable by the Directors from or the fixed salary of a

full-time employee of the Bank as shown in Note 36 to the financial statements or from related corporations) by reason of a contract

made by the Bank or a related corporation with the Director or with a firm of which, the Director is a member, or with a company

in which the Director has a substantial financial interest.

The Directors’ benefits paid to or receivable by Directors in respect of the financial year ended 31 December 2023 are as

follows:

From the

From the subsidiary

Bank company

RM’000 RM’000

Directors of the Bank:

Director fees 1,504 55

Director’s other emoluments 1,010 18

Estimated money value of any other benefits 76 -

2,590 73

Neither at the end of the financial year, nor at any time during that year, did there subsist any arrangement to which the Bank

was a party, whereby Directors might acquire benefits by means of the acquisition of shares in, or debentures of the Bank or

any other body corporate.

INDEMNITY AND TAKAFUL COST

Directors’ and Officers’ liability takaful is in place to protect the Directors and Officers of the Group and of the Bank against

potential costs and liabilities arising from claims brought against the Directors and Officers. The Bank has maintained a

Directors’ and Officers’ liability takaful up to an aggregate limit of RM40.0 million against any liability incurred by the Directors

and Officers. The gross amount of takaful contribution paid by the Bank for the Directors and Officers of Bank Muamalat

Malaysia Berhad (“Bank Muamalat”) and its subsidiaries for the current financial year was RM215,000.

OTHER STATUTORY INFORMATION

(a) Before the statements of profit or loss, statements of comprehensive income and statements of financial position of

the Group and of the Bank were made out, the Directors took reasonable steps:

(i) to ascertain that proper action had been taken in relation to the writing off of bad debts and the making of allowance

for doubtful debts and satisfied themselves that all known bad debts had been written-off and that adequate

allowance had been made for doubtful debts; and

(ii) to ensure that any current assets which were unlikely to realise their value as shown in the accounting records in

the ordinary course of business had been written-down to an amount which they might be expected so to realise.

(b) As at the date of this report, the Directors are not aware of any circumstances not otherwise dealt with in this report or

the financial statements which would render:

(i) the amount written-off for bad debts, or the amount of the allowance for doubtful debts in the financial statements

of the Group and of the Bank inadequate to any substantial extent; and

(ii) the values attributed to current assets in the financial statements of the Group and of the Bank misleading.

182