Page 422 - Bank-Muamalat-Annual-Report-2021

P. 422

420 BANK MUAMALAT MALAYSIA BERHAD

OUR PERFORMANCE

OUR LEADERSHIP

ABOUT US

OUR STRA

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

TEGY

BASEL II

PILLAR 3 DISCLOSURE

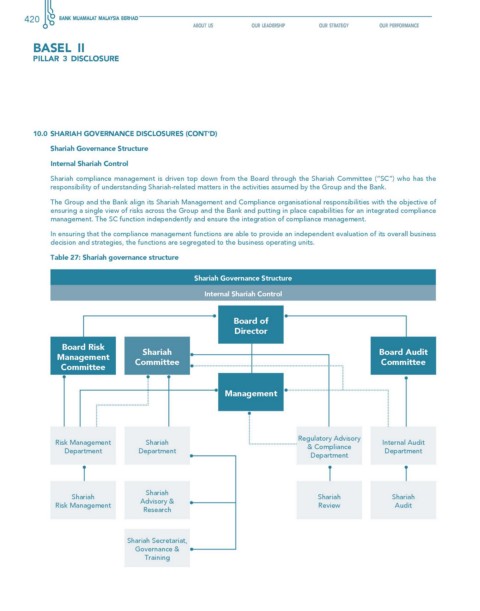

10.0 shArIAh governAnce DIsclosures (conT’D)

shariah governance structure

Internal shariah control

Shariah compliance management is driven top down from the Board through the Shariah Committee (“SC”) who has the

responsibility of understanding Shariah-related matters in the activities assumed by the Group and the Bank.

The Group and the Bank align its Shariah Management and Compliance organisational responsibilities with the objective of

ensuring a single view of risks across the Group and the Bank and putting in place capabilities for an integrated compliance

management. The SC function independently and ensure the integration of compliance management.

In ensuring that the compliance management functions are able to provide an independent evaluation of its overall business

decision and strategies, the functions are segregated to the business operating units.

Table 27: shariah governance structure

shariah governance structure

Internal shariah control

Board of

Director

Board risk shariah Board Audit

Management committee committee

committee

Management

Regulatory Advisory

Risk Management Shariah Internal Audit

Department Department & Compliance Department

Department

Shariah

Shariah Advisory & Shariah Shariah

Risk Management Review Audit

Research

Shariah Secretariat,

Governance &

Training