Page 208 - Bank-Muamalat-Annual-Report-2021

P. 208

206 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

2. sIGNIfIcANT AccOuNTING POLIcIes (cONT’D.)

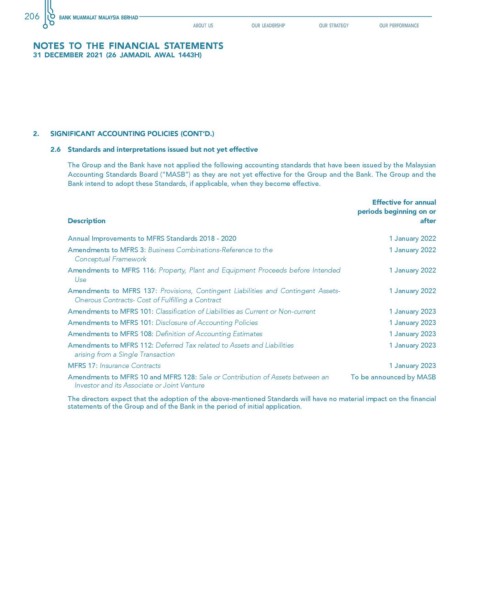

2.6 standards and interpretations issued but not yet effective

The Group and the Bank have not applied the following accounting standards that have been issued by the Malaysian

Accounting Standards Board (“MASB”) as they are not yet effective for the Group and the Bank. The Group and the

Bank intend to adopt these Standards, if applicable, when they become effective.

effective for annual

periods beginning on or

Description after

Annual Improvements to MFRS Standards 2018 - 2020 1 January 2022

Amendments to MFRS 3: Business Combinations-Reference to the 1 January 2022

Conceptual Framework

Amendments to MFRS 116: Property, Plant and Equipment Proceeds before Intended 1 January 2022

Use

Amendments to MFRS 137: Provisions, Contingent Liabilities and Contingent Assets- 1 January 2022

Onerous Contracts- Cost of Fulfilling a Contract

Amendments to MFRS 101: Classification of Liabilities as Current or Non-current 1 January 2023

Amendments to MFRS 101: Disclosure of Accounting Policies 1 January 2023

Amendments to MFRS 108: Definition of Accounting Estimates 1 January 2023

Amendments to MFRS 112: Deferred Tax related to Assets and Liabilities 1 January 2023

arising from a Single Transaction

MFRS 17: Insurance Contracts 1 January 2023

Amendments to MFRS 10 and MFRS 128: Sale or Contribution of Assets between an To be announced by MASB

Investor and its Associate or Joint Venture

The directors expect that the adoption of the above-mentioned Standards will have no material impact on the financial

statements of the Group and of the Bank in the period of initial application.