Page 196 - Bank-Muamalat-Annual-Report-2021

P. 196

194 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

2. sIGNIfIcANT AccOuNTING POLIcIes (cONT’D.)

2.3 summary of significant accounting policies (cont’d.)

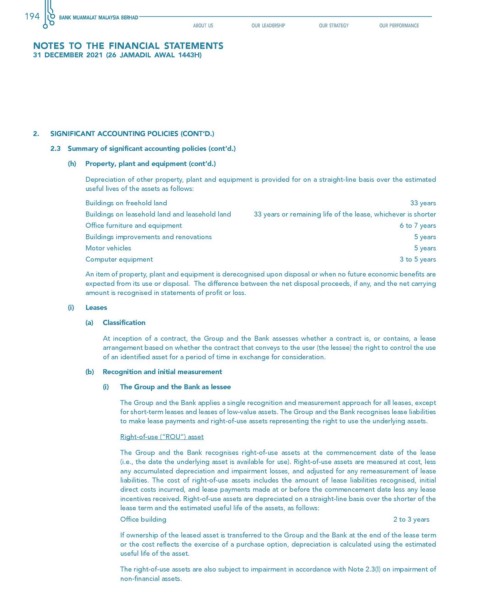

(h) Property, plant and equipment (cont’d.)

Depreciation of other property, plant and equipment is provided for on a straight-line basis over the estimated

useful lives of the assets as follows:

Buildings on freehold land 33 years

Buildings on leasehold land and leasehold land 33 years or remaining life of the lease, whichever is shorter

Office furniture and equipment 6 to 7 years

Buildings improvements and renovations 5 years

Motor vehicles 5 years

Computer equipment 3 to 5 years

An item of property, plant and equipment is derecognised upon disposal or when no future economic benefits are

expected from its use or disposal. The difference between the net disposal proceeds, if any, and the net carrying

amount is recognised in statements of profit or loss.

(i) Leases

(a) classification

At inception of a contract, the Group and the Bank assesses whether a contract is, or contains, a lease

arrangement based on whether the contract that conveys to the user (the lessee) the right to control the use

of an identified asset for a period of time in exchange for consideration.

(b) Recognition and initial measurement

(i) The Group and the Bank as lessee

The Group and the Bank applies a single recognition and measurement approach for all leases, except

for short-term leases and leases of low-value assets. The Group and the Bank recognises lease liabilities

to make lease payments and right-of-use assets representing the right to use the underlying assets.

Right-of-use (“ROU”) asset

The Group and the Bank recognises right-of-use assets at the commencement date of the lease

(i.e., the date the underlying asset is available for use). Right-of-use assets are measured at cost, less

any accumulated depreciation and impairment losses, and adjusted for any remeasurement of lease

liabilities. The cost of right-of-use assets includes the amount of lease liabilities recognised, initial

direct costs incurred, and lease payments made at or before the commencement date less any lease

incentives received. Right-of-use assets are depreciated on a straight-line basis over the shorter of the

lease term and the estimated useful life of the assets, as follows:

Office building 2 to 3 years

If ownership of the leased asset is transferred to the Group and the Bank at the end of the lease term

or the cost reflects the exercise of a purchase option, depreciation is calculated using the estimated

useful life of the asset.

The right-of-use assets are also subject to impairment in accordance with Note 2.3(l) on impairment of

non-financial assets.