Page 188 - Bank-Muamalat-Annual-Report-2021

P. 188

186 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

2. sIGNIfIcANT AccOuNTING POLIcIes (cONT’D.)

2.3 summary of significant accounting policies (cont’d.)

(b) financial assets (cont’d.)

(iii) Impairment of financial assets (cont’d)

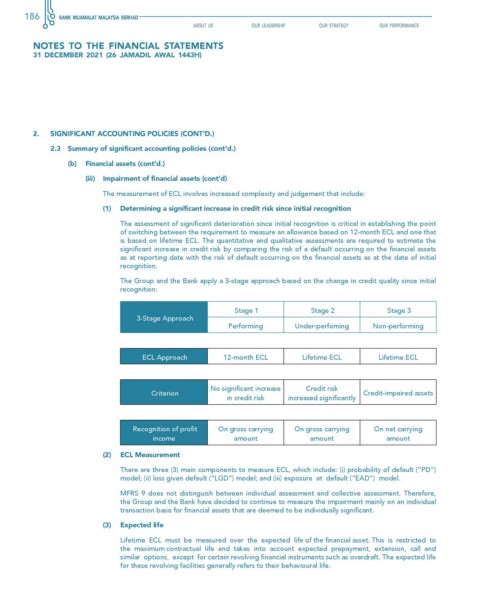

The measurement of ECL involves increased complexity and judgement that include:

(1) Determining a significant increase in credit risk since initial recognition

The assessment of significant deterioration since initial recognition is critical in establishing the point

of switching between the requirement to measure an allowance based on 12-month ECL and one that

is based on lifetime ECL. The quantitative and qualitative assessments are required to estimate the

significant increase in credit risk by comparing the risk of a default occurring on the financial assets

as at reporting date with the risk of default occurring on the financial assets as at the date of initial

recognition.

The Group and the Bank apply a 3-stage approach based on the change in credit quality since initial

recognition:

Stage 1 Stage 2 Stage 3

3-Stage Approach

Performing Under-perfoming Non-performing

ECL Approach 12-month ECL Lifetime ECL Lifetime ECL

No significant increase Credit risk

Criterion Credit-impaired assets

in credit risk increased significantly

Recognition of profit On gross carrying On gross carrying On net carrying

income amount amount amount

(2) ecL Measurement

There are three (3) main components to measure ECL, which include: (i) probability of default (“PD”)

model; (ii) loss given default (“LGD”) model; and (iii) exposure at default (“EAD”) model.

MFRS 9 does not distinguish between individual assessment and collective assessment. Therefore,

the Group and the Bank have decided to continue to measure the impairment mainly on an individual

transaction basis for financial assets that are deemed to be individually significant.

(3) expected life

Lifetime ECL must be measured over the expected life of the financial asset. This is restricted to

the maximum contractual life and takes into account expected prepayment, extension, call and

similar options, except for certain revolving financial instruments such as overdraft. The expected life

for these revolving facilities generally refers to their behavioural life.