Page 169 - Bank-Muamalat-Annual-Report-2021

P. 169

ANNUAL REPORT 2021 167

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

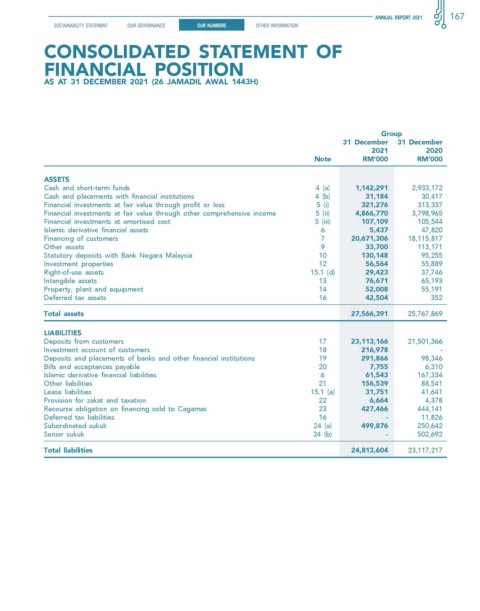

CONSOLIDATED STATEMENT OF

FINANCIAL POSITION

AS AT 31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

Group

31 December 31 December

2021 2020

note rM’000 rM’000

assets

Cash and short-term funds 4 (a) 1,142,291 2,933,172

Cash and placements with financial institutions 4 (b) 31,184 30,417

Financial investments at fair value through profit or loss 5 (i) 321,276 313,337

Financial investments at fair value through other comprehensive income 5 (ii) 4,866,770 3,798,965

Financial investments at amortised cost 5 (iii) 107,109 105,544

Islamic derivative financial assets 6 5,437 47,820

Financing of customers 7 20,671,306 18,115,817

Other assets 9 33,700 113,171

Statutory deposits with Bank Negara Malaysia 10 130,148 95,255

Investment properties 12 56,564 55,889

Right-of-use assets 15.1 (d) 29,423 37,746

Intangible assets 13 76,671 65,193

Property, plant and equipment 14 52,008 55,191

Deferred tax assets 16 42,504 352

Total assets 27,566,391 25,767,869

liabilities

Deposits from customers 17 23,113,166 21,501,366

Investment account of customers 18 216,978 -

Deposits and placements of banks and other financial institutions 19 291,866 98,346

Bills and acceptances payable 20 7,755 6,310

Islamic derivative financial liabilities 6 61,543 167,334

Other liabilities 21 156,539 88,541

Lease liabilities 15.1 (a) 31,751 41,641

Provision for zakat and taxation 22 6,664 4,378

Recourse obligation on financing sold to Cagamas 23 427,466 444,141

Deferred tax liabilities 16 - 11,826

Subordinated sukuk 24 (a) 499,876 250,642

Senior sukuk 24 (b) - 502,692

Total liabilities 24,813,604 23,117,217