Page 418 - Bank-Muamalat-AR2020

P. 418

416 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

BASEL II

PILLAr 3 DISCLOSurE

9.0 OPErATIONAL rISk MANAGEMENT (“OrM”) DISCLOSurES (CONT’D.)

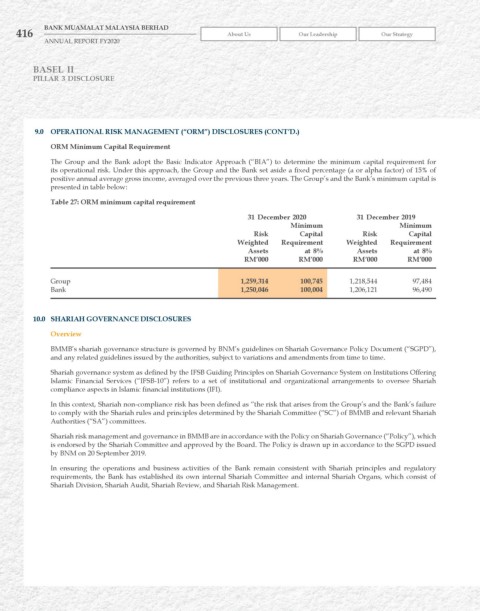

OrM Minimum Capital requirement

The Group and the Bank adopt the Basic Indicator Approach (“BIA”) to determine the minimum capital requirement for

its operational risk. Under this approach, the Group and the Bank set aside a fixed percentage (a or alpha factor) of 15% of

positive annual average gross income, averaged over the previous three years. The Group’s and the Bank’s minimum capital is

presented in table below:

Table 27: OrM minimum capital requirement

31 December 2020 31 December 2019

Minimum Minimum

risk Capital risk Capital

weighted requirement weighted requirement

Assets at 8% Assets at 8%

rM’000 rM’000 rM’000 rM’000

Group 1,259,314 100,745 1,218,544 97,484

Bank 1,250,046 100,004 1,206,121 96,490

10.0 ShArIAh GOvErNANCE DISCLOSurES

Overview

BMMB’s shariah governance structure is governed by BNM’s guidelines on Shariah Governance Policy Document (“SGPD”),

and any related guidelines issued by the authorities, subject to variations and amendments from time to time.

Shariah governance system as defined by the IFSB Guiding Principles on Shariah Governance System on Institutions Offering

Islamic Financial Services (“IFSB-10”) refers to a set of institutional and organizational arrangements to oversee Shariah

compliance aspects in Islamic financial institutions (IFI).

In this context, Shariah non-compliance risk has been defined as “the risk that arises from the Group’s and the Bank’s failure

to comply with the Shariah rules and principles determined by the Shariah Committee (“SC”) of BMMB and relevant Shariah

Authorities (“SA”) committees.

Shariah risk management and governance in BMMB are in accordance with the Policy on Shariah Governance (“Policy”), which

is endorsed by the Shariah Committee and approved by the Board. The Policy is drawn up in accordance to the SGPD issued

by BNM on 20 September 2019.

In ensuring the operations and business activities of the Bank remain consistent with Shariah principles and regulatory

requirements, the Bank has established its own internal Shariah Committee and internal Shariah Organs, which consist of

Shariah Division, Shariah Audit, Shariah Review, and Shariah Risk Management.