Page 129 - Bank-Muamalat-AR2020

P. 129

127

Our Performance Sustainability Statement Our Governance Our Numbers Other Information

Governance

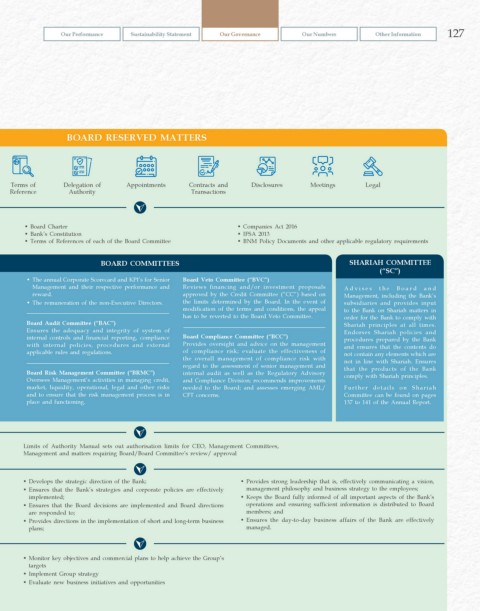

BOARD RESERVED MATTERS

Terms of Delegation of Appointments Contracts and Disclosures Meetings Legal

Reference Authority Transactions

• Board Charter • Companies Act 2016

• Bank’s Constitution • IFSA 2013

• Terms of References of each of the Board Committee • BNM Policy Documents and other applicable regulatory requirements

BOARD COMMITTEES SHARIAH COMMITTEE

(“SC”)

• The annual Corporate Scorecard and KPI’s for Senior Board Veto Committee (“BVC”)

Management and their respective performance and Reviews financing and/or investment proposals Advises the Board and

reward. approved by the Credit Committee (“CC”) based on Management, including the Bank’s

• The remuneration of the non-Executive Directors. the limits determined by the Board. In the event of subsidiaries and provides input

modification of the terms and conditions, the appeal to the Bank on Shariah matters in

has to be reverted to the Board Veto Committee. order for the Bank to comply with

Board Audit Committee (“BAC”) Shariah principles at all times.

Ensures the adequacy and integrity of system of Endorses Shariah policies and

internal controls and financial reporting, compliance Board Compliance Committee (“BCC”) procedures prepared by the Bank

with internal policies, procedures and external Provides oversight and advice on the management and ensures that the contents do

applicable rules and regulations. of compliance risk; evaluate the effectiveness of not contain any elements which are

the overall management of compliance risk with not in line with Shariah. Ensures

regard to the assessment of senior management and that the products of the Bank

Board Risk Management Committee (“BRMC”) internal audit as well as the Regulatory Advisory comply with Shariah principles.

Oversees Management’s activities in managing credit, and Compliance Division; recommends improvements

market, liquidity, operational, legal and other risks needed to the Board; and assesses emerging AML/ Further details on Shariah

and to ensure that the risk management process is in CFT concerns. Committee can be found on pages

place and functioning. 137 to 141 of the Annual Report.

Limits of Authority Manual sets out authorisation limits for CEO, Management Committees,

Management and matters requiring Board/Board Committee’s review/ approval

• Develops the strategic direction of the Bank; • Provides strong leadership that is, effectively communicating a vision,

• Ensures that the Bank’s strategies and corporate policies are effectively management philosophy and business strategy to the employees;

implemented; • Keeps the Board fully informed of all important aspects of the Bank’s

• Ensures that the Board decisions are implemented and Board directions operations and ensuring sufficient information is distributed to Board

are responded to; members; and

• Provides directions in the implementation of short and long-term business • Ensures the day-to-day business affairs of the Bank are effectively

plans; managed.

• Monitor key objectives and commercial plans to help achieve the Group’s

targets

• Implement Group strategy

• Evaluate new business initiatives and opportunities