Page 160 - Bank-Muamalat-Annual-Report-2021

P. 160

158 BANK MUAMALAT MALAYSIA BERHAD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

Directors’ rePort

PROsPecTs (cONT’D.)

The Bank will continue to operate efficiently to better manage capital and liquidity by maintaining prudent credit risk management,

proactively manage any potential stress in asset quality and implement intensive recovery plan. The Bank will also ensure effective

Risk and Compliance Management programmes are in place for a more robust enforcement of regulatory requirements throughout

its operation.

Adapting to the vast changes in the business environment, the Bank has placed greater emphasis on strengthening the business

through its new 5-Year strategic plan by intensifying digitalization effort, continuous expansion of its customer base and service

efficiency. The Bank is committed to a sustainable growth through the continuous adoption of value-based intermediation initiatives

in building stakeholders’ confidence and value.

Moving forward, underpinned by the positive momentum in 2021 and coupled with digital and technology capabilities, the Bank

anticipates a better performance for 2022.

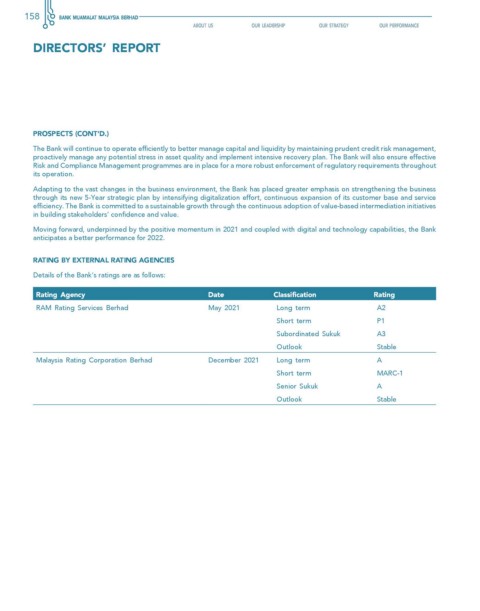

rating by external rating agencies

Details of the Bank’s ratings are as follows:

Rating Agency Date classification Rating

RAM Rating Services Berhad May 2021 Long term A2

Short term P1

Subordinated Sukuk A3

Outlook Stable

Malaysia Rating Corporation Berhad December 2021 Long term A

Short term MARC-1

Senior Sukuk A

Outlook Stable