|

M-Zahra Invest Prime Takaful

A single contribution plan that provides protection for your legacy creation and investment options to prepare your retirement savings for future usage.

- Double Protection

- Potential Investment Return

- Single Payment

- Flexibility

- Hassle-Free Application

Pelan caruman tunggal yang menyediakan perlindungan untuk peninggalan legasi dan pilihan pelaburan bagi persediaan persaraan untuk kegunaan di masa hadapan.

- Perlindungan Berganda

- Potensi Pulangan Pelaburan

- Pembayaran Tunggal

- Fleksibiliti

- Aplikasi Tanpa Kerumitan

|

|

M-Zahra Income Takaful

- Guaranteed Acceptance – No Medical Check Up Required.

- Pay Contributions For A Short Term, Enjoy A Longer Coverage

- Receive Guaranteed Cash Payments Every Year

- Receive A Special Allowance Upon Marriage Or Getting A Child

- Get High Protection Up To 300% Of The Coverage Amoun

- Penerimaan Dijamin, Tidak Perlu Pemeriksaan Kesihatan

- Bayar Caruman Untuk Tempoh Yang Singkat, Nikmati Perlindungan Yang Lebih Lama

- Terima Bayaran Tunai Yang Dijamin Setiap Tahun

- Terima Elaun Istimewa Jika Berkahwin Atau Melahirkan Anak

- Dapatkan Perlindungan Yang Tinggi Sehingga 300% Daripada Jumlah Perlindungan

|

|

M-Zahra Income Plus Takaful

- Guaranteed Acceptance – No Medical Check Up Required Up To RM500,000 Sum Covered

- Pay Contributions For A Short Term, Enjoy A Longer Coverage

- Receive Guaranteed Cash Payments Every Year Starting From First Year

- Get High Protection Up To 300% Of The Coverage Amount

- Penerimaan Dijamin, Tidak Perlu Pemeriksaan Kesihatan Sehingga RM500,000 Jumlah Perlindungan

- Bayar Caruman Untuk Tempoh Yang Singkat, Nikmati Perlindungan Yang Lebih Lama

- Terima Bayaran Tunai Yang Dijamin Setiap Tahun Bermula Dari Tahun Pertama

- Dapatkan Perlindungan Yang Tinggi Sehingga 300% Daripada Jumlah Perlindungan

|

|

M-Zahra Flexi Takaful

- Comprehensive Coverage, For Hibah, Income Replacement, Medical, Education And Retirement

- Multiple Optional Benefits That Can Be Customised To Suit Your Needs

- Reward For Excellence In Children’s Education

- Options For Investment-Related Contributions To Optimize Investments

- Perlindungan Yang Komprehensif Bagi Hibah, Pengantian Pendapatan, Perubatan, Pendidikan Dan Persaraan.

- Banyak Pilihan Manfaat Tambahan Yang Boleh Diubah Suai Mengikut Keperluan Anda

- Ganjaran Bagi Kecemerlangan Pendidikan Anak-Anak

- Pilihan Untuk Caruman Berkaitan Pelaburan Bagi Mengoptimumkan Pelaburan

|

|

Takaful myMediValue

This is a standalone individual & health takaful plan that provides comprehensive and inclusive health coverage encompassing hospitalization, surgical expenses and a host of other health benefits. Enjoy additional protection up to RM1 million with the MediBooster rider and receive daily allowance during your treatment at government hospitals. Unlock the full potential of your life with Takaful my MediValue.

Just click on the following link for a quotation: Click here

|

|

M-Zahra First Takaful

M-Zahra First Takaful is formulated for simplicity and affordability and yet, tailored to meet your protection needs with comprehensive coverage. M-Zahra First could be YOUR first takaful.

M-Zahra First Takaful dirumus untuk mudah diakses dan mampu milik dan disesuaikan untuk memenuhi keperluan perlindungan anda dengan perlindungan yang komprehensif. M-Zahra First boleh menjadi takaful pertama ANDA.

|

|

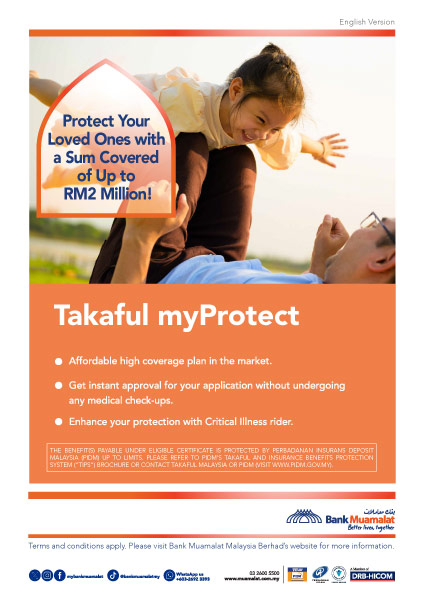

Takaful myProtect

- Affordable high coverage plan in the market.

- Get instant approval for your application without undergoing any medical check-ups.

- Enhance your protection with Critical Illness rider.

- Pelan perlindungan tinggi yang mampu dimiliki di pasaran.

- Dapatkan kelulusan segera untuk permohonan anda tanpa menjalani sebarang pemeriksaan kesihatan.

- Tingkatkan perlindungan anda dengan penunggang Penyakit Kritikal.

Just click on the following link for a quotation: Click here

|

|

M-Zahra Protect elite Takaful

A plan that goes beyond the journey—offering legacy planning alongside a range of additional benefits, ensuring your family continues to prosper into the future.

Pelan yang melangkaui perjalanan – menawarkan perancangan legasi di samping pelbagai kelebihan tambahan, memastikan keluarga anda terus sejahtera di masa depan.

|